With so many players in the insurance industry all competing for the same customers, companies often look for ways to reduce their overhead to offer more competitive rates. One innovative way of doing this is to leverage modern technology to build or configure a customer self-service portal.

While there is a larger upfront cost of rolling out self-service portals, there are numerous ways business can save money – especially in the insurance industry. A successful self-service strategy can create efficiencies in your business and build customer loyalty using modern technology.

Reduced Manual Work by Automating Claims Submission

Insurance companies can eliminate a lot of the manual labour involved in logging claims by enabling customers to enter that information themselves in a self-service portal. By accessing the portal from a smartphone, customers can add photos of their claim, geo location, and other pertinent information without requiring the insurance company to have staff directly involved.

By automating this first step of submitting a claim (FNOL – or First Notice of Loss), companies can:

- Increase accuracy of claims by applying the same business rules as if their staff had entered the claim.

- Reduce costs and accuracy by not having to manually re-key in all the details

- Reduce training time for these manual claim entry tasks

- Free up teams to focus on important tasks

- Accelerate claims submission and processing

These benefits of self-service portals end up saving money or reducing costs for insurance companies and brokers – and this is just on the claim submissions alone.

Faster Processing and Turnaround Time

Self service customer portals enable faster processing and turnaround time by reducing the leg work of the insurance specialists to collect all info and parse it into the system as mentioned above.

However, throughout the process, automated notifications can be sent to the customer to keep them updated on the status of their claim in real time. This allows team members to focus on tasks that are harder to automate (identifying issues in accounts, customizing quotes, and talking through specific issues with customers). This should reduce call volumes to the call centre for checking on claim status thus reducing costs and enhancing the customer experience by not having to wait on hold at the call centre for the next available service agent.

Customer self service portals reduce the need for manual interactions all throughout the process, saving time at every step. By removing the need for customers to physically come into the office, fill out paperwork, or wait on the phone and relay details of a claim or check in on it – you can streamline the process and ultimately get claims processed and money back to your customers faster.

Lower Customer Acquisition Costs

Insurance companies can actually lower customer acquisition costs by implementing a self service portal and leveraging the customer satisfaction that’s comes from the improved experience. When a claim is processed quickly, and the customer is paid out, the platform can prompt the customer to share a review about their experience.

The fast turnaround time on claims is also a key differentiator insurance companies can promote to stand out from the competition.

You Might Also Be Interested In:

Cut Down on Support Costs

A customer self service portal typically has an FAQ section alongside the other features where users can find answers to the most-asked questions. This saves the support team a significant amount of time from answering the same questions repeatedly. There can also be the option to launch a support ticket from with the self service portal, connecting customers with a support representative if they aren’t able to find the answer they are looking for within the platform. Gartner predicted companies that integrate customer communities into their support offerings could experience a cost reduction of 10% to 50%, mainly from the deflection of calls to an agent.

When customers enter their information digitally, it is stored under their account information and much easier to locate if an issue comes up. This means when they submit a ticket, all possible details are pre-populated for the support team and it decreases the amount of work needed to build a picture of what needs to be done to solve the problem. Costs are also reduced from not having to process, scan, and store all of the paper that the digital environment replaced.

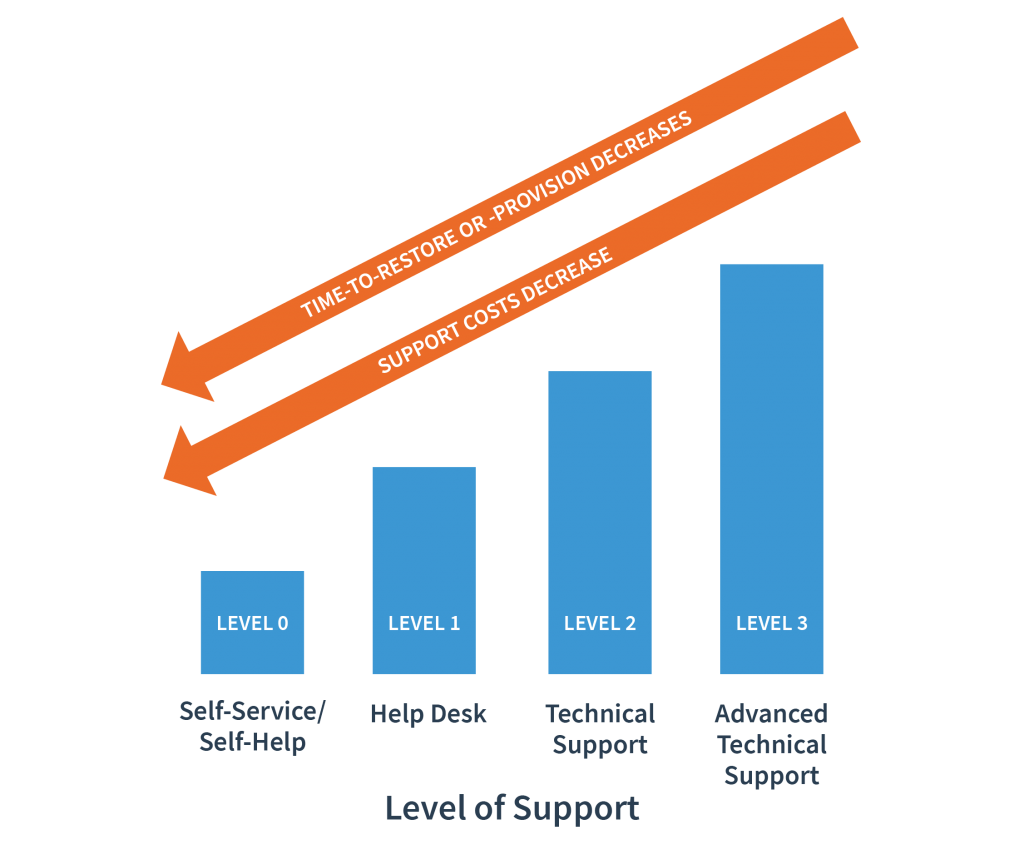

EasyVista explains the decrease in support costs, “For example, a US$ 22 Level 1 “human” password reset vs. a US$ 2 Level 0 automated reset. The ultimate goal of self-service is to shift the engagement model to the left (see chart below).”

Image source: https://www.easyvista.com/blog/calculating-the-roi-of-your-it-self-service-portal

Reduced Paper, Printing and Postal Costs

A digital platform allows customers to view their bills, account information, and other details, act or engage on them, and receive a notification once they are reimbursed. All done without sending physical communications back and forth. This saves both you and your customers money in printing and shipping costs. Keeping communications within a customer self service portal means clients have a record of what has happened without contacting the company or getting statements reprinted.

Learn More

- How To Prioritize Reduce Your It Support Tickets

- How a Self-Serve Insurance Portal Can Enhance My Customer Experience

- What’s the Right Mix of In-House vs Managed IT Services

Insurance Self-Service Portal – Getting Started

While there are many ways insurance companies can save money with self service portals and access the additional benefits that come from implementing them – deploying one for your business can be a complicated and involved project.

Business leaders need to take a holistic approach and analyze existing business processes to determine what could be migrated over to a customer self-service portal. The business and IT strategies should be aligned to gain the most efficiencies possible from such a project.

There are many digital insurance platforms on the market so its important to evaluate their fit to your company’s specific needs.

If you’re looking for guidance, at Resolute, we’ve gone through the process of researching, selecting, integrating, and deploying modern platforms for insurance companies. Our consultants have extensive experience with each stage of a platform deployment project and can share lessons learned. Contact us today to discuss how to make your customer self service portal a success.

To take full advantage of the benefits a customer self-service portal can offer – approach strategically and make sure it is the right fit for your business. If you’re not sure, contact us.

We offer a free 30-minute consult where you can go over your business idea or challenge with one of our senior consultants. We have extensive experience helping clients solve business problems using technology and have worked on many platform and portal projects.

[]