Signing up for new insurance plans, making claims, and trying to navigate insurance processes can be a daunting task for insurance customers. That’s why its critical companies make the insurance customer experience as simple and intuitive as possible to reduce some of the stress their customers may be feeling.

Customer Experience in the Insurance Industry

Many modern customer service strategies for the insurance industry involve a mix of self-service as well as omnichannel support (phone, live chat, email, etc.) for when guidance is needed. A customer service portal enables users to find solutions to their problems, check the status of their claim, and receive payment all without waiting on hold or in queue to be answered by an insurance rep.

Micah Solomon, Contributor at Forbes, explains the need for ‘seamlessness’ in omnichannel support this way:

“No matter what channel your customer enters through—your website, a phone line, an email, etc.—it should be a seamless and cohesive process. It shouldn’t feel like an entirely different experience in each area, and it shouldn’t make customers start from scratch if they’ve already shared information with your company in another channel.”

Technology allows insurers to gain valuable insights into their customers’ needs as well as giving them innovative approaches to delivering services. A customer experience portal enables greater data collection and gives insurance companies a view into what their customers are saying and how satisfied they are with their insurance experience.

You Might Also Be Interested In:

- What’s the Right Mix of In-House vs Managed IT Services

- Maintaining VS Replacing Legacy Systems

- IT Vendor Management Best Practices: How to Save Time and Money

Importance of Customer Service Strategies For The Insurance Industry

Providing top tier customer service helps improve customer retention rates, increases customer satisfaction, and reduces support frustration for both customers and support staff.

Roger Tolboom of TJIS speaks to customers’ expectations in the digital age saying, “According to the 2017 World Insurance Report, nearly three-quarters (74.8%) of tech-savvy customers place importance on the ability to send claim notifications to insurers online or via mobile. Moreover, nearly 70% of Gen Y customers value the ability to digitally renew or cancel policies.”

When it comes to the insurance customer experience, meeting and exceeding customers’ expectations is vital to attracting new customers and keeping them from switching to the competition.

How Self-Service Portals Enhance Customer Experience in the Insurance Industry

Speeds Up the Claim Approval Process – Without the need for insurance agents to manually intake claim information, process it, and find time to follow up with customers – staff can focus directly on verifying that a claim is legitimate and push it long to the next steps in the process. Thereby speeding up claim approvals and not leaving customers in the dark as to what stage their claim status is at.

For example, a cognitive computing product was able to save one insurance customer “up to 53% for FTEs (full-time employees) and warranty management activities; another customer saw cost reductions of 30 to 60% for email management and quote processing.” – Source

The faster an insurance company can process claims and approve payment to their customer, the better the insurance customer experience.

Allows for 24/7 Access to Services – Insurance companies often have customers in many different time zones which makes it hard to staff service agents for every hour that people can reach out. It’s also impossible to predict when events will occur that cause customers to submit a claim for.

An insurance customer service portal allows users to input claim information at any time. Customers can start the process of submitting claims, look for answers to their insurance questions, or get a view into the status of outstanding claims. Other 24/7 features can include retrieving historical records, account management, policy payments, and viewing when policies are set to renew.

Enables Real-time Notifications – One metric that has a major impact on insurance customer experience and satisfaction is responsiveness. A self-service portal allows insurance companies to trigger automatic alerts to customers via email, mobile alerts, push notifications, and more.

These notifications can be reactive to policy changes, updates made to an account or alerts of a known payment. They can also be used proactively to alert logged in customers when a policy renewal is upcoming or planned changes to coverage. These mobile and web alerts are powerful tools given customers can be notified, educated, and decide to act on these notifications all through the same platform without necessarily having to visit and office, make a call, or mail in a letter.

Learn More About Customer Self-Service Portal:

- What is a Customer Self-Service Portal?

- How a Customer Self-Service Portal Can Save an Insurance Company Money

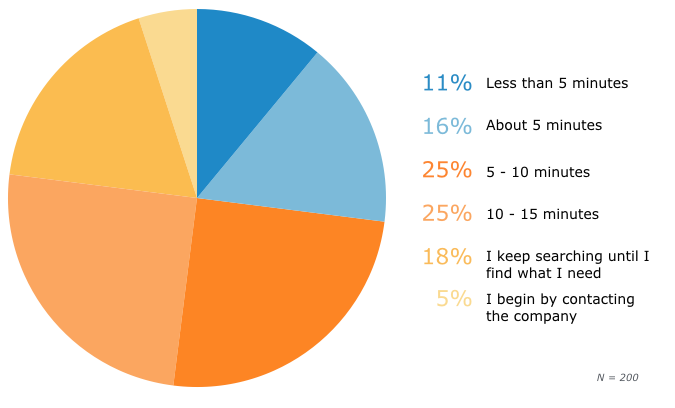

Empowers Customers to Find Solutions Themselves – By creating an easily accessible and navigable knowledge base, insurance companies can empower their customers by providing answers to their most frequently asked questions. Research shows that most customers begin by searching for an answer online before they contact customer support.

Time Spent Searching for Answer Online Before Contacting Company

Image source: https://www.softwareadvice.com/resources/customer-self-service-portal-improves-cx/

A customer experience portal allows insurance companies to put together guides and resources in video, image, and text-based format to best answer their customer inquiries. Most platforms also contain the option to reach out to a representative if they can’t find the solution they are searching for.

One downside is that companies must keep this knowledge base up-to-date with consistent content refreshes to remain current with customer needs. However, this task is considerably less time-consuming than fielding the same support questions repeatedly from customers who would prefer to find their answers online.

Allows for Information Collection and Distribution – An insurance self-service portal allows the insurer to collect additional information from the member to potentially offer additional value in terms of new products or services. It also gives companies the ability to provide policy information to the member for coverages, deductibles, premiums, and other account information.

Customer Experience Portal

Insurance is just one industry where self-service portals can save companies money, enhance the customer experience, and offer a wide range of other benefits. As companies look to modernize their processes and systems in the coming years – keep an eye out for an increase in customer service strategies for the insurance industry.

We offer a free 30-minute consult where you can go over your business idea or challenge with one of our senior consultants. We have extensive experience helping clients solve business problems using technology and have worked on many platform and portal projects.

[]